Short tenures. Working part-time. Lower wages on average. That is what characterizes the temporary employment sector. And therefore also a large part of our participants. If you work part-time, or if the salary is lower, this means your pension accrual is lower. And so a "small pension" is created. A small pension is a pension pot of up to € 10,000,-. At StiPP, more than 90% of the nearly 1.2 million participants have a small pension.

The implementation costs at StiPP

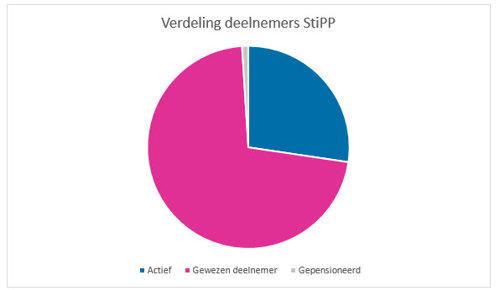

StiPP administers pensions for nearly 1.2 million people. These people can be divided into three groups:

- participants currently working in the sector (active participants)

- participants who have worked in the sector and have pension capital at StiPP (former participants)

- participants receiving pension (pensioners)

The pie chart below shows the ratio between these 3 groups within StiPP

Administering the pensions for all these participants costs money. In 2022, a total of 15.8 million euros. The implementation costs at StiPP are therefore on average € 13.47 per participant.

We try to keep costs as low as possible

Low implementation costs are important

StiPP wants as much pension contribution as possible to be used to build up pension. That is why low implementation costs are important to StiPP. Because the lower the costs, the more pension accrual can take place.

Not only low execution costs, but also low asset management costs

In addition to implementation costs, StiPP also incurs costs for investing the pension. In 2022, a total of 6.2 million euros. This is 0.27% of the average invested capital. These costs are directly deducted from the investment return. That is why low asset management costs are also important: the lower the costs, the higher the return. And the more pension!

The costs can be further reduced

The board is working towards lower execution and asset management costs. This can be done, among other things, by further automating and digitizing processes. By communicating online. But also by looking critically at what the fund invests in. The board believes that the execution costs may be a maximum of € 15 per participant/pensioner and that the asset management costs may not exceed 0.30% of the average invested capital. The board remains committed to achieving this.

More information about the execution and asset management costs can be found in the annual report.