Survivor's pension if you have not yet retired

If you die before you retire, your pension capital will be used to purchase a survivor's pension. If there are both a partner and children under the age of 18, your accrued pension capital will be divided between your partner and your children.

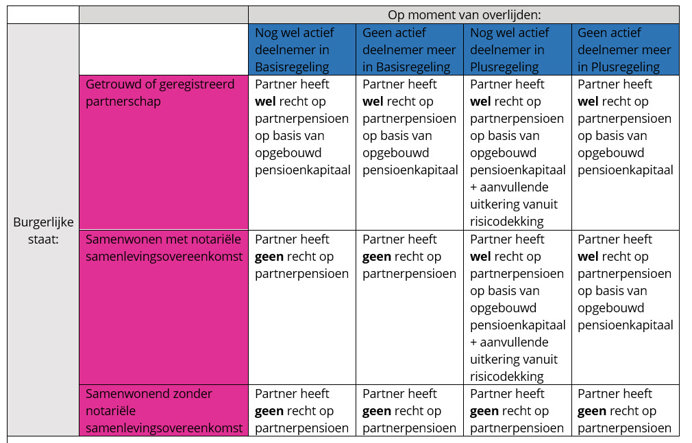

The amount of the survivor's pension and who is eligible for it depends on a number of things:

- Which scheme you participate in: Basic or Plus Scheme

- Whether you are still an active participant in the scheme at the time of death

- The amount of your accrued pension capital

- Whether there are any children under the age of 18

You will receive a uniform pension overview every year. In it you can read, among other things, the amount of capital that your partner and/or children will receive from us if you die. And how much pension they can expect to purchase with this capital.

In the table below you can read what has been arranged for your next of kin at what time. A number of things are explained in more detail below the table.

Extra survivor's pension during your participation in the StiPP pension scheme

If you die during your active participation in the Plus Scheme of StiPP, your partner will also receive a supplementary benefit from StiPP. You are automatically insured for this. This insurance stops when you no longer actively participate in the pension scheme with StiPP. If you die after active participation in the Plus Scheme, your partner will not receive a supplementary partner's pension. If you are a participant in the Basic Scheme, you are also not entitled to a supplementary partner's pension.

Who does StiPP see as next of kin?

Your surviving relative is the person with whom you are married or in a registered partnership. In addition, children up to the age of 18 are also eligible for benefits.

In the Plus Scheme, if you officially live together, your partner is also seen as a surviving relative. You must then live at the same address for at least six months and have a notarial cohabitation contract. If you participate in the Basic Scheme, your cohabiting partner is not considered a surviving relative.

Marriages and registered partnerships are registered with the municipality. StiPP automatically receives this through the municipality. If you live together, your partner will not be registered.

Partner's pension after retirement

Do you want your partner to receive a pension if you die after you have retired? That's possible. On the retirement date, you can choose to insure a survivor's pension for your partner. Your partner will receive this pension after your death for as long as your partner lives. If you choose this, you will receive a lower retirement pension. This is because you will have less pension capital left over for an old-age pension. You can make your choice via the 'retired' application form that will be sent to you.

Who sees StiPP as my partner when I am already retired?

The partner's pension after retirement is intended for the partner you have when you retire. Your partner is the person with whom you are married or in a registered partnership. Were you a participant in the Plus Scheme before your retirement? Then if you officially live together, your partner is also considered a surviving relative. At the time of retirement, you must then live at the same address for at least six months and have a notarial cohabitation contract. Will you have a (new) relationship after you retire? Then your (new) partner is not entitled to a partner's pension.

Would you like to know in which scheme you accrue pension?

StiPP has two pension schemes: a Basic and Plus scheme. First, after a waiting period of 8 weeks, you accrue pension in the Basic Scheme. If you have accrued 52 weeks of pension in the Basic Scheme, you will automatically go to the Plus Scheme.

Log in to My StiPP Pension to see which scheme you are participating in:

- Log in with your DigiD

- Go to the 'My Pension' page

- Under 'Pension details' you will find which scheme you participate in.

Please note! When applying for your retirement pension within the Basic and Plus Scheme, you can choose to purchase only retirement pension from your pension capital or retirement pension with survivor's pension (partner's and/or orphan's pension). If you have chosen to purchase an old-age pension only when you apply for this application, your partner will not receive a partner's pension upon your death.